Summary

On 6 June 2024, the Federal Court of Australia (FCA) found in favour of the taxpayer in Ierna v Commissioner of Taxation [2024] FCA 592.

The FCA determined that:

- The specific anti-avoidance rule in section 45B of the Income Tax Assessment Act 1936 (ITAA 1936) did not deem a capital return paid following an internal restructure to be an unfranked dividend; and

- The scheme did not attract the application of the general anti-avoidance rules in Part IVA of the ITAA 1936.

The Commissioner of Taxation (Commissioner) has lodged an appeal.

In brief

As the first case to consider the application of section 45B since its introduction in 1998, this case significantly advances the interpretation of the anti-avoidance provision, particularly in respect of the profits, attribution and tracing questions which are key areas of focus for the Commissioner. The FCA’s analysis departs in several key respects from that often undertaken by the Commissioner and highlights the importance of a holistic assessment of the other legislative factors relevant to a section 45B assessment, such as a company’s pattern of distributions and dividend history, which have tended to be less significant areas of focus for the Commissioner.

In a tax world where the capital management options for companies to return funds to shareholders are decreasing, this case may (subject to the Commissioner’s success on appeal) provide additional scope for capital returns to be paid, with:

- Less focus on a forensic examination of the source of the distribution;

- A more holistic analysis of the circumstances; and

- Increased clarity around the ability of the Commissioner to impose section 45B.

The failure of the Commissioner’s alternative argument on Part IVA follows a series of defeats for the Commissioner on Part IVA and underscores that Part IVA does not require a taxpayer to choose the option which results in the most tax being payable. In particular, the FCA’s decision reinforces that an alternative postulate must be commercially realistic and reasonable, having regard to the practical and economic constraints faced by the taxpayer (which can, as in this case, include tax-based constraints). The Court rejected the Commissioner’s alternate postulate in favour of the taxpayers’ alternative postulate, resulting in no tax benefit being derived from the scheme, and the non-application of Part IVA.

Case Facts and Timeline

Background

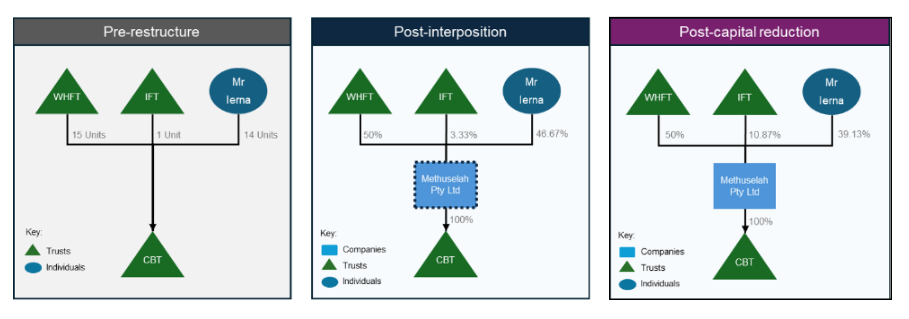

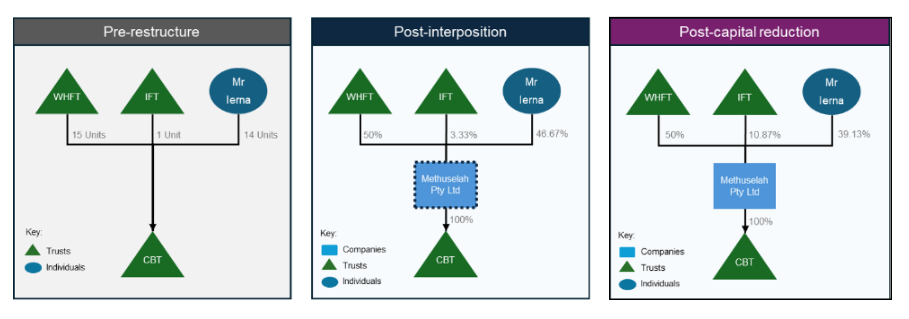

The City Beach business was established in early-1985 by Carmelo Ierna and Melville Hicks, who structured the business through a unit trust known as the City Beach Trust (CBT). The units in CBT were, and largely remained, pre-Capital Gains Tax (CGT) assets. Ownership of the CBT units was divided between Mr Ierna, the Ierna Family Trust (IFT) and the William Hicks Family Trust (WHFT), with each holding 14, 1 and 15 units respectively.

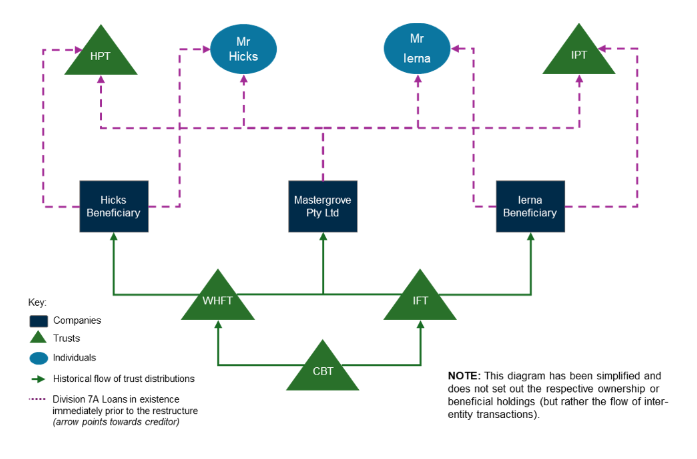

Mastergrove Pty Ltd (Mastergrove), a company controlled by Ierna and Hicks, played a crucial role in the group financing arrangements. Funds from CBT were distributed to IFT and WHFT , with these family trusts then distributing to various corporate beneficiaries including Mastergrove and, in later years, to companies referred to as Hicks Beneficiary and Ierna Beneficiary. These beneficiaries then lent the monies back to various related entities. These intra-group loan balances were placed on terms compliant with the provisions of Division 7A of the ITAA 1936. As complying loan agreements under Division 7A, these loans required annual repayments comprising both interest and principal (and with these arrangements came a significant degree of additional administrative and financial complexity).

Restructure

In 2010, the Commissioner released Taxation Ruling TR 2010/3 (TR 2010/3). In broad terms, TR 2010/3 sets out the Commissioner’s views on the application of Division 7A to unpaid present entitlements (UPEs) of trust estates and, effectively, reflected a reversal in the accepted practice in respect of UPEs. In particular, the Commissioner’s views in TR 2010/3 severely disadvantaged trusts conducting business operations such as the CBT, in that such a structure resulted in UPEs which would need to be subject to interest and minimum repayments in compliance with Division 7A to prevent those UPEs being treated as deemed dividends.

In response to the challenges presented for the CBT structure by the Commissioner’s views in TR 2010/3, as well as the general inability to accumulate profits in a trust structure, a restructure of the City Beach business entities (including CBT) was contemplated and later implemented. This restructure involved the interposition of a holding company between the existing unitholders and CBT to create a corporate structure and a subsequent selective share capital reduction to provide funds to allow the effective repayment of the existing Division 7A loans.

On 18 April 2016, a new holding company called Methuselah Holdings Pty Ltd (Methuselah) was incorporated and on 20 May 2016, Methuselah and the existing unit holders of CBT entered into Unit Sale Agreements under which Methuselah issued shares to the CBT unit holders in exchange for their units in CBT. The restructure was undertaken in a manner consistent with the “top hatting” rollover provisions in the then newly enacted Division 615 of the Income Tax Assessment Act 1997 which resulted both in no taxable gain being triggered on the exchange, and in the shares in Methuselah being treated as pre-CGT interests to the extent the units exchanged for those shares were also pre-CGT interests.

Selective capital reduction and repayment of Division 7A loans

Following the interposition of Methuselah, a selective capital reduction in accordance with the requirements of section 256C of the Corporations Act 2001 (Cth) was undertaken. This involved cancelling 10,400,000 ordinary shares in Methuselah held by each of Mr Ierna and WHFT for consideration of $2.50 per share, resulting in total proceeds of $26 million per shareholder (no shares held by IFT were cancelled).

No cash payments were made to Mr Ierna or WHFT in respect of this selective capital reduction, with the transactions instead giving rise to loan receivables which were subsequently assigned and offset against certain Division 7A loans. The loan receivables, assignments and repayments were recorded in the financial accounts of the relevant entities via accounting entries.

In practical terms, the selective capital reduction allowed Mr Ierna and WHFT to realise part of the value of their deemed pre-CGT shares in Methuselah and use these proceeds to repay certain outstanding Division 7A loans.

Australian Taxation Office compliance action

In 2018, the Commissioner commenced an audit of the City Beach group’s 2016 restructure, particularly examining the selective capital reduction and the subsequent repayment of the Division 7A loans. The Commissioner issued several determinations to the taxpayers:

- A determination under section 45B of the ITAA 1936 that the capital return should be treated as an unfranked dividend and included in Mr Ierna’s and Hicks’ assessable income, based on the view that the scheme was entered into for the purpose of enabling each shareholder to obtain a $26 million capital benefit.

- A determination that Division 7A of the ITAA 1936 applied to elements of the loan repayment process to deem these payments to be unfranked dividends (thereby subjecting these payments to income tax in the hands of the recipients).

- As an alternative to the above determinations, a determination under the general anti-avoidance provisions in Part IVA of the ITAA 1936 that the restructure was a scheme entered into for the dominant purpose of obtaining a tax benefit, the benefit being the tax would have been payable on a fully franked dividend sufficient to settle the Division 7A loans (rather than a tax-preferred capital return).

The Commissioner issued amended assessments to various entities in accordance with the above determinations triggering significant additional tax payable, and the taxpayers challenged these assessments in the FCA.

The FCA found in favour of the taxpayer on both the section 45B and Part IVA issues (the Commissioner’s position with respect to Division 7A was separately withdrawn). Our key insights and observations are set out below.

A&M’s key observations

The section 45B issue

As background, section 45B is an anti-avoidance provision designed to address schemes which provide a tax benefit by converting what would otherwise be assessable dividends into tax-preferred capital returns (i.e. capital returns paid in substitution for dividends).

Section 45B has been frequently considered by the Commissioner in the context of class and private ruling applications. However, this is the first time section 45B has been judicially considered, and there are some important distinctions between the approach of the FCA and the practice of the Commissioner:

- In class and private rulings, the Commissioner has tended to focus on the existence of any realised or unrealised profits in the company paying a capital return (or an associate of that company), advocating various complex methodologies to determine whether the capital return is “attributable” to those profits – including tracing of funds, average capital per share calculation, and the slice approach, amongst others. Whether the capital benefit is “attributable” to profits or capital is one of the “relevant circumstances” in subsection 45B(8) which must be considered in determining whether a scheme was entered into or carried out for a more than incidental purpose of enabling shareholders to obtain a tax benefit (i.e. whether section 45B applies). Often, this “attribution question” leaves taxpayers with a heavy evidentiary burden in demonstrating that the capital return is not in any way factually sourced from profits.

- The FCA’s analysis departs from the forensic examination of the source of a capital return often advocated by the Commissioner. Although the FCA did not need to explicitly consider the tracing of funds or other methodologies, the FCA’s analysis focused on the cause of the capital return, rather than the precise source, suggesting that such forensic approaches may not be required. In particular, the FCA considered that while the existence of profits is of course relevant, the term “attributable” to profits implies a causal link between the existence of profits and the distribution itself, and accepted the taxpayer’s arguments that the existence of profits must actually be a contributing cause to the decision to return capital, giving consideration to all the surrounding factors (not just the mere existence, or not, of profits).

- Although the Commissioner has historically acknowledged the “contributory causal connection” involved in the “attribution question”[1] the FCA’s strong emphasis on a causal connection is somewhat at odds with the tracing and forensic analysis more recently adopted by the Commissioner in class and private rulings. However, the FCA’s analysis is consistent with section 45B’s role as an anti-avoidance provision and fundamentally requiring a non-incidental purpose of providing a tax benefit (rather than a purely factual analysis of the source of a distribution). In this case, Logan J accepted the taxpayer’s arguments that Methuselah, as a newly incorporated entity with no current year or accumulated profits, no distribution history and only a share capital account, could not have provided a capital benefit “attributable” to profits. In this respect, it did help the taxpayers’ case that CBT – being the entity which had historically conducted the City Beach business and did have a history of accounting profits – was not clearly an “associate” of Methuselah due to the unique nature of the “associate” tests for trusts.

- While the case considers a specific and relatively narrow fact pattern, the FCA’s analysis confirms important aspects of the “attribution question” and the meaning of “profits” for section 45B purposes. In particular, the case confirms that the term “profits” in subsection 45B(8)(a) takes its ordinary meaning, with the surrounding analysis focussing on the existence (or not) of accounting profits in Methuselah and related entities. Significantly, Logan J strongly rejected a wider construction of the term “profits”, and dismissed the Commissioner’s argument that the capital return was attributable to “profits” equal to an increase in value of the CBT units (from $1 per unit on issuance to $2,587,626 per unit as valued in the financial accounts at the time of the restructure) which was then rolled over into the new Methuselah corporate holding structure. The fact that such an economic gain had not been subject to tax (and potentially never would be, given the Methuselah shares inherited pre-CGT status under Division 615) did not mean that its realisation via a capital return pointed to a purpose of obtaining a tax benefit. In particular, the FCA considered that this outcome was clearly within Parliament’s intention in providing tax rollover for corporate restructures. As such, the selective capital reduction was not a “scheme” to provide a capital benefit to shareholders, but combined with the restructure itself reflected a return of genuine share capital to enable the repayment of Division 7A loans, the future accumulation of profits in Methuselah as the business entity, and the ongoing viability of the City Beach business.

- More broadly, the decision confirms that, following a restructure, a company’s post-restructure share capital can represent “real” share capital which is capable of being distributed to shareholders without attracting the operation of section 45B, provided the restructure is undertaken at market value. This is both contrary to the Commissioner’s arguments in this case, and also the long-standing position of the Commissioner that post-restructure share capital may represent capitalised profits, the distribution of which attracts section 45B – see for example, Example 5 in PSLA 2008/10 – Application of section 45B of the Income Tax Assessment Act 1936 to share capital reductions.[2] In rejecting the Commissioner’s arguments on this point, Logan J undertook a holistic assessment of the group’s business, pointed to the legislative history of section 45B and respected the accounting treatment and characterisation of the capital return, concluding that the capital return was wholly “attributable to” (actually sourced in or caused by) Methuselah’s share capital account, which reflected “genuine” share capital of $75 million.

- As expected, the Commissioner has now lodged an appeal. As well as significantly advancing the interpretation of section 45B, this decision and its appeal is likely to impact the form and content of any new public guidance to be provided by the Commissioner on capital management activities (including capital returns). Public consultation in respect of these matters was undertaken by the Commissioner in late 2023, although no timeline for any new guidance has been provided.[3] But for now, this decision represents a win for taxpayers and confirms important aspects of the profits and attribution questions – and subject to the Commissioner’s successful appeal may provide additional scope for capital returns to be paid as a legitimate capital management option, in a capital management landscape that is otherwise narrowing in options.

The Division 7A issue

- Division 7A and, more importantly, its application to unpaid entitlements from trusts and the Commissioner’s views on the matter have been the topic of recent debate. While the implications of Division 7A and the existence of Division 7A loans that required repayment were a key element of the overall case, this case does not consider the application of Division 7A to UPEs or the Commissioner’s views expressed in TR 2010/3 or Taxation Determination 2022/11, and does not provide any further clarification of the matters considered in Bechtel Australia Pty Ltd v Commissioner of Taxation [2023] FCA 676 or Bendel & Anor v Commissioner of Taxation [2023] AATA 3074.

- The case does, however, provide insight into the proper interpretation of elements of Division 7A. In particular, the Commissioner advanced a position with respect to the potential application of Division 7A to the repayment of certain Division 7A loans, which were the subject of separate proceedings in which the Commissioner ultimately determined to not proceed with his position of the application of Division 7A to these repayments.

- Logan J’s commentary on the Commissioner’s application of Division 7A in this case is noteworthy in the overall context of the Commissioner’s application of Division 7A to various taxpayer matters. In particular, the Commissioner sought to construct the application of section 109C (regarding payments to shareholders or their associates) somewhat in abstract of the broader circumstances (i.e. that the payments which allegedly attracted section 109C were made in repaying Division 7A loans, rather than making a payment for the benefit of the shareholder or the associate).

- With respect to the potential application of section 109C to repayments of loans, Logan J noted it “entailed the odd notion that the repayment of a loan by a borrower was a payment to the borrower.” While not necessarily precedential, these comments may lend credence to the overall position that the Commissioner should apply the provisions of Division 7A in a manner more aligned to the common interpretation of the provisions rather than seeking to apply the provisions in accordance with a strict, ‘literal’ reading.

The Part IVA issue

- The FCA finding in favour of the taxpayer on Part IVA follows the Commissioner’s recent high-profile defeats in Mylan Australia Holding Pty Ltd v Commissioner of Taxation (No 2) [2024] FCA 253 (Mylan) and Minerva Financial Group Pty Ltd v Commissioner of Taxation [2024] FCAFC 28, and specifically highlights the need for a Part IVA alternative postulate to be a realistic alternative. Our insights on these cases can be found here and here.

- In this case and as an alternative to sections 45B and Division 7A applying, the Commissioner contended that the restructure, and particularly the selective capital reduction, was a scheme aimed at avoiding tax and proposed an alternative postulate of Mastergrove (i.e. the financing entity) distributing fully franked dividends to allow repayment of the Division 7A loans. Logan J rejected this on the basis that there were insufficient funds in the group to cover the tax liability that would arise from such franked dividends (and there was no real ability to liquidate assets or debt fund such a tax bill while ensuring the commercial viability of the business itself). As such, the FCA considered the Commissioner’s alternative postulate “just not reasonable”. Instead, Logan J accepted the taxpayers’ alternate postulate that the pre-CGT units in CBT would have been transferred to Methuselah for market value consideration of shares worth $23 million and cash of $52 million (which would in turn be used to repay the Division 7A loans). As this alternate postulate did not result in a tax benefit, Logan J concluded that Part IVA could have no application.

- This case again demonstrates that Part IVA does not require a taxpayer to choose the option which involves paying the most tax. In particular, the case highlights that despite section 177BC of the ITAA36 (which Logan J considered) tax-based reasoning for the infeasibility of an alternative postulate can be legitimate if it reflects the actual financial constraints faced by the entities involved. This holistic view of a transaction – and its proposed counterfactuals – and balancing multiple transaction considerations (including tax) is consistent with the analysis in other recent Part IVA cases, including the FCA’s analysis in Mylan – in which one of the reasons used to justify obtaining an Australian tax benefit was the U.S tax benefit in structuring a transaction in a particular way. The FCA’s analysis underscores the importance of considering the practical feasibility of alternative postulates when applying Part IVA and looking at a transaction holistically, and adds to a series of recent significant defeats for the Commissioner on Part IVA.

[1] Refer paragraph 61 of PS LA 2008/10 | Legal database (ato.gov.au)

[2] PS LA 2008/10 | Legal database (ato.gov.au)

[3] 2023 Completed matters | Australian Taxation Office (ato.gov.au)

https://www.alvarezandmarsal.com/insights/ierna-v-commissioner-taxation-2024-fca-592-federal-court-finds-favour-taxpayer-and