Publish Date

Apr 08, 2021

A&M Tax Advisor Update

Now that the 2020/21 tax year has ended, employers should be thinking about the various compliance deadlines coming up in the next few months around employee benefits, expenses and share schemes.

We are seeing HMRC step up their activity in this area, and so it is essential that employers have robust processes and controls in place to remain compliant. This article sets out some of the key employment tax deadlines coming up, as well as other important reminders for employers.

End of year reporting

Forms P11D and P11D(b)

Employers are required to report details of certain taxable benefits provided to employees, by 6 July 2021, using Form P11D (where the benefits are not already covered by a payrolling arrangement with HMRC or under a PSA). A copy of the P11D must also be provided to each employee by 6 July 2021. Employer’s Class 1A NIC is payable at a rate of 13.8% on certain P11D benefits and must be paid by employers by 19/22 July 2021.

PAYE Settlement Agreement (PSA)

A PSA is a formal arrangement with HMRC whereby employers choose to settle the tax due (on a grossed-up basis) on certain employee benefits. Typical benefits we see included in PSAs are staff entertaining, gifts and taxable long service awards. Employer’s Class 1B NIC is also payable at a rate of 13.8% on the value of PSA benefits and must be paid by employers by 19/22 October 2021.

A PSA must be agreed with HMRC by 5 July following the end of the tax year to which it relates, however, it is best practice to agree this before the benefits covered are actually provided to employees. Once a PSA is agreed with HMRC, it will remain in place for future tax years (or until amended by the employer/HMRC).

ERS Annual Returns

Employers should also now think about submitting their Employment Related Securities (ERS) Annual Return for any new and existing share plans (HMRC tax advantaged and non-tax advantaged), for the 2020/21 tax year. HMRC will accept share plan returns from the 6th April 2021 and the deadline is 6th July 2021.

Reporting on the ERS Annual Return involves a number of key tasks that are essential in submitting the return to HMRC. These include:

HMRC enquiries

Any review by HMRC (or an advisor on a due diligence) will look at P11D and PSA compliance and ERS Annual Returns, so have copies ready. The common errors/issues we often see arising in such reviews in relation to P11Ds, PSAs and ERS returns include:

Penalties

Late P11D filings will incur a penalty of £100 for every 50 employees. HMRC will also charge statutory interest on late paid Class 1A NIC. Additional percentage-based penalties can also be applied for incorrect P11Ds, based on whether HMRC deem that the employer has taken reasonable care and whether the mistake is deemed to be careless, deliberate and/or concealed.

Furthermore, where HMRC uncover errors as part of a review, they will often ask employers to settle unpaid tax on the benefits on the employee’s behalf, on a grossed-up basis, often covering several tax years. This can all result in significant liabilities for an employer as a result of reporting benefits incorrectly.

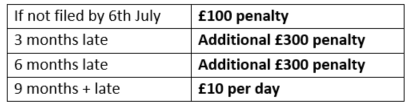

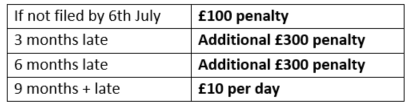

Late ERS filings will result in similar penalties from HMRC as follows:

A penalty of up to £5,000 can also be inflicted for material inaccuracy in an ERS return which is not immediately addressed and resolved.

Other key employer changes

Some of the other recent key changes affecting employers include:

Key dates to remember – summary

Other deadlines and submissions may also apply. Please let us know if we can assist with these.

How we can help?

At Alvarez & Marsal Taxand, our Reward and Employment Tax team have extensive experience in advising employers on their ongoing employment tax and NIC obligations. We can offer a range of advice and services to assist employers in respect of P11D, PSA and ERS Annual Return compliance, as well as providing bespoke advice on all areas of employee reward and employment tax, including short term business visitor returns and special arrangements for tax equalised employees or overseas workers in the UK (App4-8 agreements).

https://www.alvarezandmarsal.com/insights/employer-compliance-end-year-update